Lions in Love

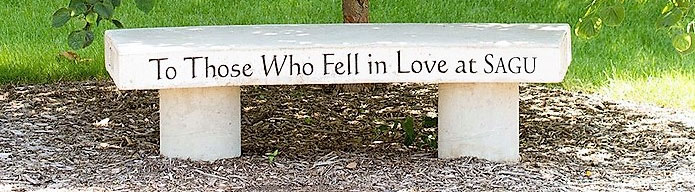

The bench will be a tribute to honor all former and future students who have met and fell in love at SAGU. Its inscription will read “To Those Who Fell in Love at SAGU.” Our hope is the bench will come to symbolize the value of a Godly Marriage and act as an encouragement to those seeking one.

The bench will be supported completely by couples who are interested in funding this project. Southwestern Women's Auxiliary (SWA) would like for couples who have met and fell in love at SAGU to consider donating a hundred dollars to the completion of this project.

Upon completion, the bench will be located just right of the brick walkway directly in front of the Shaeffer Center. This new addition to SAGU campus is part of the continuing campus beautification effort of Southwestern Women’s Auxiliary.

Additional funds raised over the actual purchase cost will be used for additional beautification projects on campus.Donations of $100 and over, will be provided with the opportunity to have their name engraved on a ‘Donor Brick’.

Tax Deductible Donations

In general, contributions to charitable organizations may be deducted up to 50 percent of adjusted gross income computed without regard to net operating loss carrybacks. Contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations are limited to 30 percent adjusted gross income (computed without regard to net operating loss carrybacks), however. Exempt Organizations Select Check uses deductibility status codes to indicate these limitations.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases. Exempt Organizations Select Check uses deductibility status codes to identify these limitations.

Taken from www.irs.gov